Through EasyWeb online banking and TD's mobile app, you can send funds to 150+ countries and territories around the world. Funds are taken out of eligible TD chequing accounts, savings accounts or lines of credit and are credited to your recipient's bank account within 1-5 business days. Transfers cost up to $25 depending on how much you're sending, the receiving country and the currency of the TD account funding the transfer. Login to your TD EasyWeb online banking account to send a Western Union money transfer.

You can send funds to over 200 countries in over 130 currencies. Cash pick-ups are supported, as are transfers directly to your recipient's bank account. You may also be able to send to a mobile wallet, depending on the destination country and which mobile phone provider your recipient uses. Transfers typically arrive the same business day, although it could take up to several days. Read our full review of Western Union money transfer services for more information.

TD offers a variety of ways to send money, from traditional wire transfers to electronic transfers using Interac and Visa Direct. Many of these options can be accessed easily through TD EasyWeb online banking or the TD mobile banking app. And if TD's in-house transfer services don't meet all your needs, you can access Western Union's services from your EasyWeb or mobile banking account. The plan is quite affordable and is made for frequent US travelers/purchasers.

The monthly account fee is $4.95; however with a minimum account balance of US$3,000 this can be waived. In terms of the associated US credit card received from initiating the US Borderless Plan there are several benefits. Fees incurred from non-TD ATM transactions are waived regardless of your account balance. Furthermore, if your account balance meets the minimum requirement, other non-TD fees will be reimbursed.

Another benefit of having a TD US Dollar Visa card is that it gives you access to preferred TD exchange rates from TD currency exchange while avoiding conversion fees and currency exchange services. Currently, the TD borderless plan offers exchange rates roughly 1.5% above the market USA exchange rate while traditional rates are 2% or more. Lastly the TD US Dollar Visa Card can be used at one of many US TD Bank ATMs without paying additional system fees outside of foreign exchange fees. This account is aimed at businesses with relatively low levels of turnover and straightforward business needs. It doesn't need a high deposit to open the account, and the monthly fee is lower than for the other two checking accounts we cover here. You'll also get a TD Bank Visa debit card and 24/7 online banking, as is the case for all these accounts.

On the downside, the Simple Checking account has a fairly low level of included transactions and deposits, and there's no way to avoid the monthly maintenance fee, the only exception for the latter being non-profits. TD Bank operates in Canada as TD Canada Trust while US cross border services are maintained by TD Bank. Having a strong US operating arm allows it to offer what it calls the US Borderless Plan. In the past, to conduct transactions between Canada and the United States, you essentially needed two separate accounts located in each country which made transactions slow and cumbersome.

The TD Bank US Borderless Plan eliminates this problem by essentially creating one integrated platform for all of your cross border banking needs. It can be accessed using the TD Canada Trust easy web online platform. This includes a US dollar account in Canada which comes with a US credit Card with annual fees waived and many discounts and insurance benefits.

The plan also allows for the purchase of a US mortgage with little hassle. Overall it is a convenient and accessible option for Canadians banking in the US. Compared to RBC's cross border solutions, it can be seen as slightly more comprehensive and all inclusive while BMO's cross border solutions are the more fragmented option. This account is designed for businesses which have a moderate level of transaction activity.

It offers some extra features over Simple Checking, such as the ability to waive the monthly maintenance fee if you keep your balance high enough. It may also offer rewards if you link your account with a personal checking account — details may change, so be sure to check the latest details. You will pay quite a bit more each month for these extra features, though, and the minimum starting balance is also higher. There is also disappointment for those hoping to be able to access Canadian TD bank accounts in the US as US staffs are not able to access Canadian accounts and vice versa; however, this is standard for all banks. Another con associated with the nature of cross-border transactions, and as previously mentioned, is that transactions tend to take more time.

Traditional ATM or debit transactions can take 1-3 days to show up on your statement while bill payments to payees can take 5-7 days to be processed. It is important to note that automatic transfers are also not possible. This account is aimed at businesses that need to deal with greater levels of turnover. It offers much higher limits on deposits each month before an additional fee is charged, and there's a lower per-item fee if you go over the included transaction limit. You'll also get your first three monthly maintenance fees waived automatically. This account also waives the fee for using non-TD ATMs, though the ATM company itself may still charge its own fee.

In return for these extra features, you'll pay the highest monthly fee of the three checking accounts, and the minimum opening deposit is also quite a bit higher than for the other two. When you make a payment, your financial institution's online banking app or website will display the date your payment was made. Payments are usually received by the CRA within 5 business days.

To avoid fees and interest, please make sure you pay on time. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number. Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers.

Check the status of your transfer on Western Union's website, by phoning Western Union or by visiting an agent location. You can also check your bank account to verify that the money has cleared your account, although it may take some time to be received. Yes, you can get 24/7 access to your accounts and a wide variety of banking functions through TD EasyWeb online banking services and TD's mobile banking app. You can send Interac e-Transfers, Visa Direct transfers, bill payments and Western Union transfers using these platforms.

TD Online Accounting helps businesses increase and accelerate their cash flow by providing a self-service, digital onboarding experience to help business owners get paid electronically. As a payment facilitator, Autobooks enables a business to begin invoicing within moments of enrollment and to start processing payments shortly after. For ease of use, TD Online Accounting is available to current TD business customers with a business checking account who are enrolled in online banking. One thing to note about PNC is that its monthly fees are significantly lower than TD Bank's, but PNC Bank requires a higher minimum balance of $500 to keep its standard checking account free from month to month. If you're just looking for a standard checking account, TD Bank may be an easier option for affordable checking.

With over 1,250 locations throughout the Northeast and Southeast regions of the U.S., TD Bank offers a robust brick-and-mortar presence and an array of checking and savings account options. However, compared with other banks — particularly online banks — TD Bank falls short in terms of offering competitive rates and minimizing fees. You can pay your personal and business taxes to the Canada Revenue Agency through your financial institution's online banking app or website. Most financial institutions also let you set up a payment to be made on a future date. All checking accounts charge monthly maintenance fees, but most of those fees can be waived by maintaining a minimum balance or making monthly deposits. The only account that does not offer the ability to waive the fee is the TD Simple Checking account, but it also does not require a minimum daily balance.

Most conventional bank accounts charge a monthly maintenance fee, and TD Bank's checking accounts are no different. When you pay this fee, it covers you for a certain number of transactions each month. You may also get other bonuses, depending on the account type you pick. Once again, look carefully to see how each account differs, as some features may have limits that exceeding will cost you extra.

The flip side of that is that, with some account types, if you keep a high enough balance in your account, the monthly fee may be waived. You can open a Wise account for free, and you don't have to get any minimum balance together, either. As soon as your account is set up, you'll have local bank details for the US, Australia, New Zealand, the UK, and the euro zone. Using any of these major currencies, you'll have the ability to receive funds without having to pay a fee.

You'll get the mid-market rate we mentioned a moment ago, plus there's just a single, upfront, low fee to pay. These include several TD Bank small business account options, a range of credit cards, and personal loans. In each case, there'll be specific eligibility criteria that you'll need to fulfill. They'll also all have their own set of features, as well as fees and charges that you may need to pay. Because of that, it's important to check what the setup is in your particular part of the country. The information you'll need can be found on the TD Bank website, or you can go into a local branch if you prefer.

By doing this, you'll be able to work out whether a particular TD Bank product is right for your needs. Another aspect of TD bank's online banking service is TD Bank EasyWeb. The Easyweb is mainly for business people, but anybody who is 18 years or older, a Canadian resident and has a TD personal or business banking account can register. This online service lets you manage your business banking anywhere and anytime. You can monitor your accounts, pay bills, transfer funds and much more from your office, home or on-the-go.

A TD Bank account requires only basic information to set up and offers a variety of perks. While each account charges monthly fees, you can waive most fees by meeting certain criteria. If you're looking for reliable banking services with quality customer support, consider opening a checking, savings, or money market account with TD Bank.

Accelerating transaction settlement times is especially important for businesses as they seek to maintain a healthy cash flow as a result of COVID-19. In terms of how easy the product is to use, it is quite simple to sign up. Signing up simply requires a phone call or a visit to the branch to talk to a representative that can facilitate the process. All that is required is a Social Insurance Number, Driver's License or Health Card, Bank Account at TD, and a Passport.

Once set up, the accounts can be accessed on the TD Canada Trust Easy Web platform. You are also able to transfer up to $100,000 per day free of charge by phone wire and up to $2,500 using TD Canada Trust online banking free of charges. Support is available 24/7 through their dedicated phone support line and informational website. Furthermore, the TD Exchange rate can be found online 24/7.

Lastly, a big advantage is that both American and Canadian accounts are visible at the same time online on the Canada Trust easy web platform for ease of transfer and bill payment. For TD Canada Trust, this comes in the form of the TD Borderless Plan which includes preferred TD exchange rates with seamless and convenient TD Canada Trust online banking tools. For your convenience, we took the time to check out TD's services to answer major questions and write an overall review on the product below. If you would like to read more reviews, articles, or view our blog click here. If you can maintain a daily balance of at least $2,500, TD Bank will reimburse you for all ATM fees incurred. Another standout checking account is TD Bank's Convenience Checking account, as it requires a low minimum balance of $100 to waive its $15 monthly maintenance fee.

There's no substitute for having as much information as possible at your fingertips when you choose a business bank account. It's something that needs care — but the more you know, the better your chances of finding a product that's ideal for you and your company. Conventional providers like TD Bank offer a range of business checking accounts, but you can also think about new alternatives like the Wise borderless account. You can think of the time you put into thinking about your choice as an investment.

It can really repay your effort if you end up with the account that best suits you in terms of features, cost, and convenience. Your next move is to find out about the fees and limits that the account you're looking at imposes. These can vary a lot between accounts, so this is a really important step.

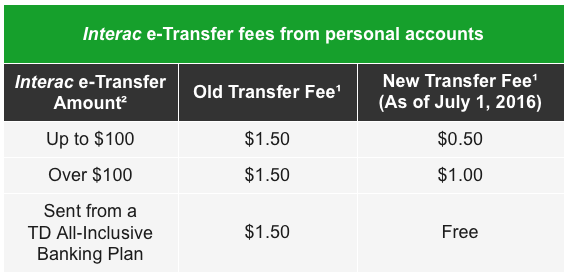

You'll also want to check to see whether there are charges for things like making a lot of deposits, using ATMs outside the bank's own network, or making international transactions. Want to send money to your child, landlord, co-worker or a friend? If they have a bank account at a Canadian financial institution, you can send money any time by using the Interac e-Transfer service available in RBC Online Banking1 or the RBC Mobile1 app. Online brokerage BMO InvestorLine and robo-adviser WealthSimple are among the financial institutions that have adopted two-step authentication. A few banks use a version of this type of security when clients want to complete certain transactions online, say changing personal contact info. But TD's move may be the most sweeping introduction of two-step authentication in online banking so far.

A couple of the bank's clients have contacted me directly to complain, and many others have been discussing the pros and cons on my Facebook personal finance page. Free TD chequing accounts are available to newcomers for 6 months. Clients can also waive the monthly fees by maintaining a minimum balance. Seniors get a 25% fee rebate on most TD chequing account offerings. TD Bank has three different savings accounts, all with different interest rates.

Each account comes with free mobile deposits and the ability to use any TD Bank ATM. You can also link any TD Bank savings account with a TD Bank checking account to set up overdraft protection. In addition, transferring money between Canadian TD accounts and American TD Bank accounts are free of wiring transfer costs. Related to this is that to open a US based TD Bank account, a US address is not necessary. Lastly, transacting between Canadian and US bank accounts can tend to take longer than a domestic transfer and a big advantage is TD's extended business hours where it is open 7 days a week and longer than other banks. Areas in which TD Bank falls short are its fees and interest offered.

While many checking and savings accounts have no monthly maintenance fees without needing to meet any qualifications, many of TD Bank's products require customers to jump through hoops to get their fees waived. Additionally, the interest offered on TD Bank's deposit products is minimal when compared with the bank's online-only peers. This review covers everything you need to know about TD Bank so you can determine whether it's a good option for you. While TD Bank offers a variety of financial services, this review focuses on its checking and savings account products. TD Bank offers long hours for many branches and 24/7 phone support.

Plus, it has over 1,900 ATMs from Maine to Florida, and customers have free access to TD Bank's ATMs in Canada. Customers have the option of banking online, or using TD Bank's mobile banking app, which is available for iOS and Android devices. And there's a monthly fee of $5, which is waived if you can maintain a $300 minimum daily balance. For the first 12 months only, you can avoid the fee by transferring $25 monthly from a TD checking to savings account. For customers with larger balances, TD Beyond Savings can earn higher rates, but if your balance falls below $20,000, the monthly fee is $15. Thankfully, many banks are beginning to understand the need for fast and easy banking, especially in the digital age.