The plan is quite affordable and is made for frequent US travelers/purchasers. The monthly account fee is $4.95; however with a minimum account balance of US$3,000 this can be waived. In terms of the associated US credit card received from initiating the US Borderless Plan there are several benefits. Fees incurred from non-TD ATM transactions are waived regardless of your account balance.

Furthermore, if your account balance meets the minimum requirement, other non-TD fees will be reimbursed. Another benefit of having a TD US Dollar Visa card is that it gives you access to preferred TD exchange rates from TD currency exchange while avoiding conversion fees and currency exchange services. Currently, the TD borderless plan offers exchange rates roughly 1.5% above the market USA exchange rate while traditional rates are 2% or more. Lastly the TD US Dollar Visa Card can be used at one of many US TD Bank ATMs without paying additional system fees outside of foreign exchange fees.

TD offers clients the possibility of opening a personal foreign currency account in pounds sterling. Customers who maintain a balance of at least £500 at the end of each month pay no monthly fees whatsoever. You get unlimited transactions with no fees, but you can't bank via ATM machine, EasyWeb, or debit payment.

TORONTO – Starting today, transferring money just got easier for TD customers. Whether it's for family living abroad, a gift for a friend, or support for a student studying overseas, with the click of a mouse the money will be received within 48 hours and as quickly as 30 minutes. TD Bank operates in Canada as TD Canada Trust while US cross border services are maintained by TD Bank. Having a strong US operating arm allows it to offer what it calls the US Borderless Plan. In the past, to conduct transactions between Canada and the United States, you essentially needed two separate accounts located in each country which made transactions slow and cumbersome.

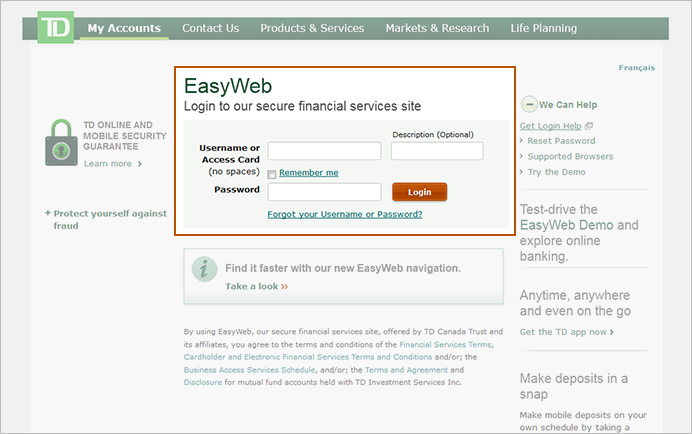

The TD Bank US Borderless Plan eliminates this problem by essentially creating one integrated platform for all of your cross border banking needs. It can be accessed using the TD Canada Trust easy web online platform. This includes a US dollar account in Canada which comes with a US credit Card with annual fees waived and many discounts and insurance benefits.

The plan also allows for the purchase of a US mortgage with little hassle. Overall it is a convenient and accessible option for Canadians banking in the US. Compared to RBC's cross border solutions, it can be seen as slightly more comprehensive and all inclusive while BMO's cross border solutions are the more fragmented option. Customers looking for a personal account in euro can opt for a foreign currency account in exchange for a monthly fee of EUR 1.75.

As above, they can make as many transactions as they wish without paying any additional service charges. However, they can't use ATM machines, EasyWeb Internet Banking, or debit payments to manage their transactions. Manage your accounts, pay your bills on time and easily send money with our internet banking services.

We've made a commitment to keep your online banking and mobile transactions as safe as possible. A modern financial service like Wise uses the mid-market rate on all transfers and conversions. You pay a small fee and with it's free to open a borderless multi-currency account, that has no monthly fees either. There you can manage and send dozens of different currencies all from the same account. Soon you will also be able to get a multi-currency debit card. There is also disappointment for those hoping to be able to access Canadian TD bank accounts in the US as US staffs are not able to access Canadian accounts and vice versa; however, this is standard for all banks.

Another con associated with the nature of cross-border transactions, and as previously mentioned, is that transactions tend to take more time. Traditional ATM or debit transactions can take 1-3 days to show up on your statement while bill payments to payees can take 5-7 days to be processed. It is important to note that automatic transfers are also not possible.

In terms of how easy the product is to use, it is quite simple to sign up. Signing up simply requires a phone call or a visit to the branch to talk to a representative that can facilitate the process. All that is required is a Social Insurance Number, Driver's License or Health Card, Bank Account at TD, and a Passport. Once set up, the accounts can be accessed on the TD Canada Trust Easy Web platform. You are also able to transfer up to $100,000 per day free of charge by phone wire and up to $2,500 using TD Canada Trust online banking free of charges.

Support is available 24/7 through their dedicated phone support line and informational website. Furthermore, the TD Exchange rate can be found online 24/7. Lastly, a big advantage is that both American and Canadian accounts are visible at the same time online on the Canada Trust easy web platform for ease of transfer and bill payment. In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your financial institution.

Small business clients are offered foreign currency accounts in several denominations. There's sadly no information on the foreign currency accounts that you can get, besides US dollar ones. Instead you need to visit a branch for details, as their Small Business Foreign Exchange page instructs. For TD Canada Trust, this comes in the form of the TD Borderless Plan which includes preferred TD exchange rates with seamless and convenient TD Canada Trust online banking tools. For your convenience, we took the time to check out TD's services to answer major questions and write an overall review on the product below.

If you would like to read more reviews, articles, or view our blog click here. In a proven case of online fraud, you are protected by the 'Customer Services Rules', which ensure that your funds are returned to your bank account by your Financial Institution. These 'Rules' are based on the reputable Canadian Code of Practice for Consumer Protection in Electronic Commerce. While we work with all stakeholders, as well as security experts, to maintain the ongoing security of our services, there are actions that you can take as well. You are encouraged to regularly check your bank statements to verify that all transactions have been properly documented. If entries do not accurately reflect transaction activities - for example, if there are missing or additional transactions you should immediately contact your financial institution.

US Dollar TD Every Day Business Three monthly plans with fees based on the number of transactions, 50 deposit items, and monthly fee rebates for balances starting from US$20,000. US Dollar Basic $1.25 per transaction , $0.22 per deposit item, $2.50 for every $1,000 cash deposit, $5.00 monthly plan fee. Opt for Wise and pay nothing for opening an account. With the borderless account, your business can get its very own local bank details for several regions around the world – so your clients can pay and get paid locally.

Below is the official TD fee schedule for foreign currency accounts. They come with no transaction fees and they offer unlimited transactions. But banking via EasyWeb Internet Banking, ATM machines, and debit payment purchases are out of the question.

Best of all, Transferwise makes it very easy for me to move my USD income into whichever bank and currency I choose. If I want to transfer those US dollars into my USD bank account with TD Bank in the States, so I can pay my US Visa card, no problem! If I want to turn them into Canadian dollars in my TD Canada Trust, no problem! I can convert the money myself, at Transferwise's great rates, and then transfer the money to my Canadian account. It takes a couple of days for the transfer to go through but it's hassle free. EasyWeb lets you send money with Interac e-Transfer to another person or vendor in Canada.

All you need is their email address or mobile number and a bank account at a Canadian financial institution. Recipients are usually notified within a minute by text or email when you send the money. External transfer services are available for most personal checking, money market and savings accounts. To use these services you must have an Online Banking profile with a U.S. address, a unique U.S. phone number, an active unique e-mail address, and a Social Security Number.

Your eligible personal deposit account must be active and enabled for ACH transactions and Online Banking transfers. The interbank rate, also known as the mid-market rate is something you probably want to know about. It's the rate, that banks use to trade among each other.

When money exchange services and banks set their own rates to sell you currency, it can be considered a additional fee. You may get very different rates, with varying levels of markup, from different providers. And should you frequently be exchanging currency or dealing in large sums, it can add up quite quickly to bigger amounts. While it is the standard practice of financial institutions to use a markup on the rate, the downside of this practice is, that you do not know the percentage of markup that's being used. That percentage is still a cost that the buyer of the currency will take on. And as it varies by who is selling it to you, it would give a better overview of the total fees, if this was disclosed in a more clear way.

In addition, transferring money between Canadian TD accounts and American TD Bank accounts are free of wiring transfer costs. Related to this is that to open a US based TD Bank account, a US address is not necessary. Lastly, transacting between Canadian and US bank accounts can tend to take longer than a domestic transfer and a big advantage is TD's extended business hours where it is open 7 days a week and longer than other banks. As a leading customer service provider, TD Bank Canada Trust offers a broad range of financial products and services to personal and small business customers.

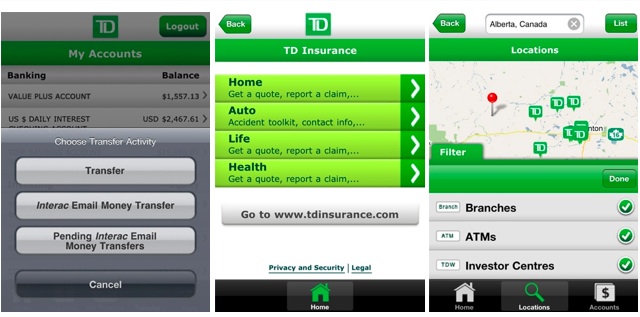

As part of the TD Bank Financial Group, with headquarters located in Toronto and offices around the world, TD Bank Canada Trust administers anywhere, anytime banking solutions through telephone and Internet banking. We feature more than 2,600 ATMs and a network of approximately 1,100 branches across Canada. To conclude, TD Trust has quite a diverse offering for personal and business customers looking for foreign currency accounts. But what it all comes down to for a Canadian who wants to bank in a variety of denominations is due diligence.

A bit of research can go a long way, and hopefully you'll find the best solution for your particular needs. You can deposit or send USD to your TD Trust account using the Foreign Exchange Transfer service either in branch or via EasyWeb (up to US$250,000 or equivalent). You can also send over 25 major currencies by wire transfer or foreign currency bank drafts.

For those wishing to travel to Cuba and use debit, TD Canada Trust Visa Debit Card provides an option to use debit aside from CIBC and De Jardin's equivalent. If interested, feel free to find out more on the TD Canada Trust website or phone in to have any questions answered. If you would like to read more articles like this one, or would like to find out how much more you can save on US dollar exchanges by going with Knightsbridge FX click here. While independent providers such as Knightsbridge Foreign Exchange can provide you with the best rates, it is sometimes easier or more convenient to go with your local bank. Luckily, if you bank with TD Canada Trust, RBC Bank, or Bank of Montreal there are cross border solutions for those that travel to the US on a semi-frequent to frequent basis.

If you would like to see how Knightsbridge FX can provide you with the lowest exchange rates, take a look at the best foreign currency exchange rate in Canada. For personal accounts, you will need to provide your Social Security number, email address and phone number to enroll in Online Banking. You will also be asked to verify your enrollment using either your ATM/CheckCard Number and PIN, or a Customer Number . TD Canada Trust is the commercial banking operation of the Toronto-Dominion Bank in Canada. They serve over 14 million customers and provide a full range of financial products and services. You can bank with TD Canada Trust through its retail branch network, mobile app which is accessible 24/7, telephone, Internet banking and 'TD Green Machine' automated banking machines.

Looking for td canada trust easy web online banking login? Find top links for easy and hassle free access to td canada trust easy web online banking login. When it comes to foreign currency accounts, you need to consider the rates at which the bank operates with, the possible markup and the various fees added to your monthly bill to understand all costs associated.

TD Canada Trust is TD Bank Financial Group's customer-focused personal and small business banking business. TD Canada Trust is a great option for Canadians that want a chequing or savings account and need consumer banking services. TD Canada Trust offers good interest rates and most of their accounts tend to come with various fee structures to help serve a wide variety of people. If it's the first time you are accessing CRA's online service using your banking information, you will also need to enter your postal code, SIN, and certain numbers from your tax return to complete the sign-up. Once you have entered all of the required information, you will have limited access to your CRA My Account. To access all of the features your CRA My Account has to offer, full enrolment must be completed and a security code is needed.

The chart in this link shows which services are available with Limited and Full Access. I wanted to get the Chase Sapphire rewards card recommend by NerdWallet, but even though I'm a US citizen, I didn't have enough of a US credit history to qualify, because I've lived in Canada for the past twenty years. Canada Trust was established in 1864 in London, Ont to acquire savings deposits to fund mortgage lending, with trust services added later. Several branches were opened in the Prairies in the late 1800s to funnel surplus eastern savings in the form of mortgages to western farmers and developers to finance western development.

After World War II the company focused on mortgage lending in cities and on lending to corporations investing in plants and equipment. Paying bills online eliminates the need to sit down and write a check, find a postage stamp, address an envelope and put the check in the mail. A number of Toronto-Dominion customers took to social media Friday to report problems accessing their online banking accounts and issues with the mobile app. TD Canada Trust offers bank accounts, credit cards, mortgages and other financial services to both businesses and individuals. Online banking is available both through the website and mobile apps. Yes, you can use the INTERAC® Online service on any computer where you can access the Internet and your financial institution's online banking service.

Check with your financial institution for advice on how to safely bank online when using a public computer. Online Banking gives you real-time account information. You can view check images, stop payments on checks, track your debit purchases and set up other tools to manage your money including e-mail balance alerts and online statements. I have bank accounts with TD Canada Trust and I occasionally need to add a "personal payee". One used to need to call them in order to do this, but now it appears that you can do this yourself using online banking as long as you know how.

This might save you some effort, especially if you dislike banking over the phone. TD offers a couple of different USD personal accounts. These enable you to convert and shift money across the border when you need it, using online banking or the TD app. In today's open world of digital nomads, frequent travellers and global purchasing, multi-currency accounts and similar solutions are sought after, to make cross-border banking easier. If you're thinking about opening a foreign currency account with TD — short for The Toronto-Dominion Bank — then this article is here to give you an overview. To my amazement, and despite all the marketing from TD about its cross-border banking, it is very hard to get US dollars I deposit in Canada into my US dollar accounts in the States.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.